Omni Logistics Board of Directors Issues Letter to Forward Air Shareholders

Highlights Powerful Strategic Rationale for Combined Company, Shared Interests with Forward Air Shareholders, and Highly Compelling Value Creation Opportunity

DALLAS, Nov. 17, 2023 /PRNewswire/ — The Board of Directors of Omni Logistics (“Omni”), a technology-driven provider of global multimodal logistics solutions and specialized services, today issued a public letter to shareholders of Forward Air Corporation (NASDAQ: FWRD) (“Forward Air”).

###

The new, vertically integrated company will be a more efficient, differentiated, and indispensable partner to shippers.

The new, vertically integrated company will be a more efficient, differentiated, and indispensable partner to shippers.

Dear Shareholders of Forward Air,

Much has been said about the combination of Omni Logistics and Forward Air, particularly in the last few weeks. The Omni Board of Directors believes it is important for Forward Air shareholders to hear directly from us about who Omni is, the background of the transaction, the compelling financial and strategic rationale, and the go-forward plans for the combined company.

The proposed combination between Omni and Forward Air is rooted in a simple yet powerful thesis: creating the premier global, integrated provider of comprehensive logistics services. This was the rationale articulated by both parties when the transaction was announced in August, and it remains equally powerful today. We believe that you – the owners of Forward Air – are poised to realize significant upside by capitalizing on the enormous value creation potential of the combined company.

As future significant shareholders in the combined company, our incentives are fully aligned with yours. We remain deeply confident in Omni and Forward Air’s industry-defining potential together. Our conviction has been reinforced by overwhelmingly positive feedback from customers across the value chain, who are doing more business with both companies since the transaction’s announcement, in anticipation of the unique value proposition our combined platform will offer.

Why Are We Fighting for This Combination?

Our Board members have been involved with building some of the most significant companies in the logistics industry. Throughout our decades of experience, there has been one constant lesson – if you take care of your customers, you will take care of long-term stock value.

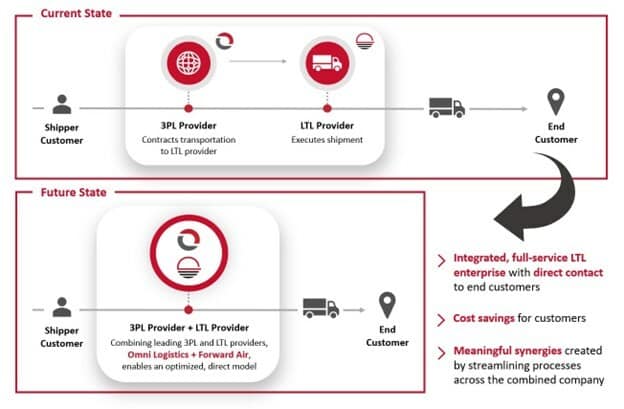

This transaction is the best answer for customers, and that is worth fighting for. This combination represents a once-in-a-generation opportunity to cause a seismic shift in the industry and “change the model.” It allows Forward Air to have a direct relationship with the customer, instead of through an intermediary. It removes a layer of cost and the customer wins.

We are not looking for a quick exit. The transaction is not for cash – it is for equity in the go-forward combined company. We believe in it, and we intend to be in it for the long haul.

Who We Are

Omni is the premier asset-light freight forwarder, with a robust track record of growth and value creation. Omni has expanded its customer count from 500 to approximately 7,000 customers over the past eight years, and nearly two-thirds of the largest customers rely on Omni for multiple services, with very high retention rates – Omni’s top 50 customers have an average tenure of more than 10 years. Omni has received numerous awards for its success in the industry, including being named a top 100 logistics provider by Inbound Logistics and Transport Topics, and its leaders have been recognized with honors from outlets such as the Dallas Business Journal and 3BL.

Omni is a privately held company, and its shareholders consist of several highly experienced and well-capitalized institutional investors with specific expertise in the transportation and logistics sector. Collectively, Omni shareholders represent billions of dollars in assets under management and decades of experience building and growing leading companies. The shareholders have invested through multiple cycles, have significant capital available, and are 100% committed to ensuring the continued success of the business, no matter the current industry dynamics or economic climate.

Background to the Transaction

In early 2023, when Forward Air proactively approached Omni about a strategic combination, the company was not for sale. Numerous world-class logistics companies and investment firms have reached out over the years seeking to acquire Omni. Omni’s Board did not pursue these opportunities because none of these options would have enabled Omni to accelerate its growth faster than it could on its own. However, the combination with Forward Air represented a transformational transaction from the Omni Board’s perspective, which is why we responded to Forward Air’s outreach and worked in good faith towards a transaction.

Omni has long had tremendous respect for Forward Air, its talented employees, and its customer service. The two companies know each other well: Omni and Forward Air have maintained an extensive commercial relationship for decades and share a common view about the industry dynamics that are prioritizing integrated solutions and direct customer relationships.

As part of its multi-year “Grow Forward” initiative, Forward Air wanted to accelerate its ability to work directly with shippers, since the majority of its current customer relationships are with intermediaries like Omni – Forward Air’s largest LTL customer. The industry has been quickly evolving towards a more integrated service model for customers. Forward Air has acknowledged the need to expand its serviceable market by trying to build direct solutions serving small- and medium-sized shippers that do not otherwise work with forwarders.

At the same time, Omni was embarking on a multi-year growth strategy centered on being the leading technology-enabled provider of logistics solutions for customers with high-value freight, with a focus on driving density and scale within its growing domestic ground LTL network. A key aspect of Omni’s strategy has been continuing to build out Omni’s proprietary LTL network, which has enabled the company to win customers and lower their unit costs. The opportunity to combine with Forward Air, the leading provider of domestic expedited LTL services, would significantly accelerate Omni’s long-term growth strategy as well.

A Transformative Opportunity to Achieve Both Companies’ Strategies

Bringing together the most expansive LTL network for expedited freight with the premier high-value freight forwarder checks all the boxes for customers: we believe the combined company will offer the best capabilities and quality of service, while eliminating a meaningful layer of cost and complexity, to be the lowest unit-cost provider. As any casual observer of the global supply chain would note, the past few years of supply chain disruption and volatility have accelerated customers’ needs for increased reliability and reduced costs. The new, vertically integrated company will be a more efficient, differentiated, and indispensable partner to shippers.

As a result, shareholders will have the opportunity to benefit from opportunities that can only be achieved through this transformative combination:

- Enhancing Forward Air’s strategic position in the industry, quickly and efficiently. By combining two highly complementary businesses, we will create the definitive leader in domestic expedited LTL as the lowest-cost, integrated provider of choice. Supplementing its current focus on serving smaller shippers directly, Forward will immediately access Omni’s larger, blue-chip direct shipper base in attractive end-markets, driven by Omni’s established commercial engine and track record of rapid organic growth.

- Driving cross-sell advantage with complementary capabilities. Omni has developed a differentiated cross-sell commercial engine and go-to-market strategy that is dedicated to offering integrated solutions to shippers, with a long track record of success. The combined platform, along with its full suite of complementary logistics solutions, will serve as a springboard to accelerate cross-sell opportunities for high-value freight and funnel more customers to its expedited LTL network.

- Creating the lowest-cost provider to customers across the value chain. The combined platform represents a win for existing customers as well as a significant segment of shippers that does not currently procure expedited LTL through forwarders. We believe concerns about alienating customer groups are misplaced, as evidenced by customers’ reactions since the announcement of the transaction: Omni’s LTL revenue pipeline from end-customers has multiplied nearly fivefold, while Forward Air recently stated its average daily volumes with domestic freight forwarders increased by 14%.

- Leveraging Omni’s highly experienced leadership. Omni’s CEO, JJ Schickel, has extensive executive and board experience in logistics and has built a diverse management team with decades of expertise growing and integrating successful global logistics businesses. In addition, the Omni Board collectively holds decades of experience building leading logistics companies, and the combined company will be supported by long-term, patient investors with meaningful “skin in the game.”

- Positioning to navigate industry headwinds. Logistics companies have experienced a variety of challenges in recent years between supply chain issues and customers’ heightened cost sensitivity. Without significant investments of capital, time, focus, and hiring, it is challenging for any organization to organically support an entire portfolio of solutions or offer a unique, integrated value proposition of this scale. But together Omni and Forward Air can do so almost immediately upon close. As a combined platform, the company will be in a materially stronger competitive position to achieve these objectives, adapt to the rapidly evolving industry environment, and outperform the market.

Achieving Long-Term Prosperity Together

Our belief in the power of the combination is not limited to words on a page.

Based on the Omni shareholders’ enthusiasm for Omni’s standalone value creation plan, and the compelling rationale of the transaction with Forward Air, it was critical for the transaction to be structured with meaningful equity consideration. This is not a “cash out” deal – greater than 85% of the proceeds for Omni shareholders is in Forward Air stock, which will result in Omni shareholders becoming significant minority owners of the combined company. This was intentional: Omni shareholders have strong conviction in the value creation opportunity of the combination and are placing a big bet on its future.

We empathize with Forward Air shareholders who have suffered a loss in value since the announcement of the transaction. Based on Forward Air’s current trading levels, the equity value to Omni’s shareholders has declined by approximately $700 million in aggregate compared to the value when the transaction was announced.[1] Despite this, Omni has not sought to renegotiate or renege on the transaction. In fact, some Omni shareholders have acquired additional shares of Forward Air stock, underlining their conviction in the future combined company.

Omni’s Board consists of long-term and deeply committed investors who strongly believe the combined company will have numerous levers to meaningfully enhance shareholder value, including:

- Unlocking substantial synergies, both immediate and sustainable. The synergy opportunities from the transaction are tremendous – and many are easily achievable within months of close. After an extensive review, Forward Air and Omni have identified $125 million in EBITDA cost and revenue synergy opportunities. Nearly half of those synergies can be executed on the cost side in the first six months. That is immediate value readily realizable once the transaction is completed.

- Achieving enhanced profitability targets. Vertical integration will remove a layer of wholesale cost to capture the full economic value of the combined company’s differentiated LTL network designed to move high-value freight on an expedited basis. In our view, the pro forma combined company can achieve metrics that will warrant a premium valuation relative to Forward Air’s current and historical levels.

- Executing on clear path to rapid deleveraging. We carefully considered the combined company’s leverage before agreeing to the transaction. Our businesses are highly cash generative, and Omni’s asset-light model requires minimal capex. Through synergy realization and other potential strategic initiatives, the combined company will be well-positioned to quickly deleverage following the closing.

Where Do We Go From Here?

The Omni Board remains 100% committed to closing the transaction with Forward Air. We believe both businesses will achieve greater value creation together and the combined company will be a leader in a reshaped LTL industry, capable of serving customers in the best way possible. We look forward to continuing the conversation with you to maximize the potential of the future company and our respective stakes in it.

The Omni Logistics Board of Directors

###

Omni is advised by Alston & Bird, LLP; King & Spalding LLP; Wachtell, Lipton, Rosen & Katz; Potter Anderson & Corroon LLP; Goldman Sachs & Co. LLC; and J.P. Morgan Securities LLC.

About Omni Logistics

Omni Logistics is a global multimodal provider of air, ocean, and ground services. Every supply chain solution is designed according to each customer’s specific freight needs, challenges, and objectives, regardless of mode, time requirements, or cost. Leveraging the expertise and advanced training of an expansive global workforce in more than 100 locations, Omni Logistics focuses on removing supply chain inefficiencies and providing low cost-per-unit solutions to approximately 7,000 customers worldwide. In addition to operating a full portfolio of multimodal solutions both domestically and internationally, Omni Logistics manages a robust portfolio of supplemental services for enterprises dependent on the efficient movement of high value freight.

Forward-Looking Statements

This press release includes forward-looking statements that are based on information currently available to Omni, Omni’s beliefs, as well as on a number of assumptions concerning future events. Forward-looking statements are not a guarantee of performance and are subject to a number of uncertainties and other factors, which could cause the actual results to differ materially from those currently expected. In providing forward-looking statements, the company does not intend, and is not undertaking any obligation or duty, to update these statements as a result of new information, future events or otherwise.

Media Contact

Jeremy Fielding / Nathan Riggs / Mark Fallati

Kekst CNC

KekstOmni@kekstcnc.com

1 Based on Forward Air’s August 9 (day prior to the transaction announcement) closing share price of $110.00 and November 16 closing share price of $64.76

SOURCE Omni Logistics, LLC